Mirror protocol is bringing FAANG tokenized stocks on EasyFi

Mirror Protocol, a decentralized finance (DeFi) platform for assets tokenization (mAssets), will be enabling the first-ever tokenized stocks and commodities on a Layer 2 DeFi lending protocol, following its partnership with EasyFi. The development today means users will soon be able to receive loans from EasyFi, using their tokenized stocks and commodities as collateral.

Advertisements

EasyFi debuts tokenized stocks and commodities money markets

According to the announcement on Tuesday, these tokenized assets will include FAANG stocks – i.e., Facebook, Amazon, Apple, Netflix, and Google, and commodities like oil as mAssets. Following the partnership, these mAssets will be available on EasyFi’s Binance Smart Chain (BSC) based lending protocol, enabling the holders to receive loans in the form of stablecoins (USDT, BUSD, DAI) against the tokenized stocks as collateral.

“EasyFi will integrate the mAssets listed on Terra Finance on Mirror protocol such as — mAAPL, mFB, mGOOGL, mAMZN, mNFLX, mTSLA, mTWTR, mMSFT, mQQQ, mUSO — as new money markets on our Binance Smart Chain based protocol. These markets will be enabled one-by-one in due course of time,” the announcement reads.

Similar to wBTC, mAssets tracks the actual value of the underlying assets. Today’s development will provide users an option to borrow capital without having to close/sell their tokenized stocks or commodities.

Advertisements

DeFi lending

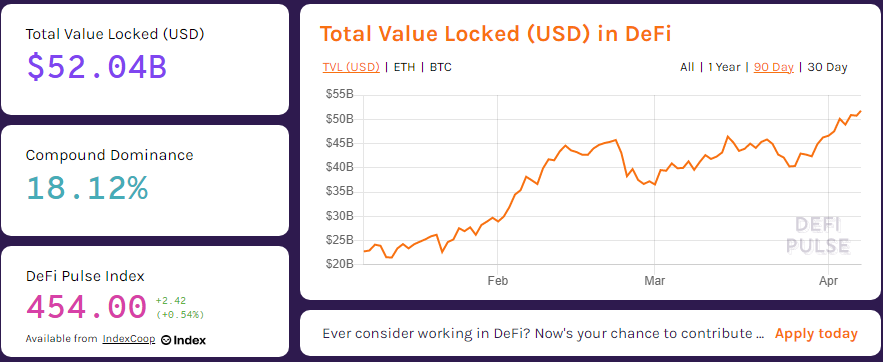

The decentralized lending market has seen massive growth over the past months. For the record, the lending market is currently the largest in DeFi, accounting for over $25 billion in assets locked, according to DeFi Pulse. Compound, Maker, and Aave are the top-three largest decentralized lending platforms in terms of assets locked.

Overall, there are $51.7 billion in assets locked in DeFi projects, which is the highest valuation ever recorded.

Advertisements